Posted by:

Category:

Comments:

Post Date:

10 Best Fintech Stocks To Buy Now

Contents:

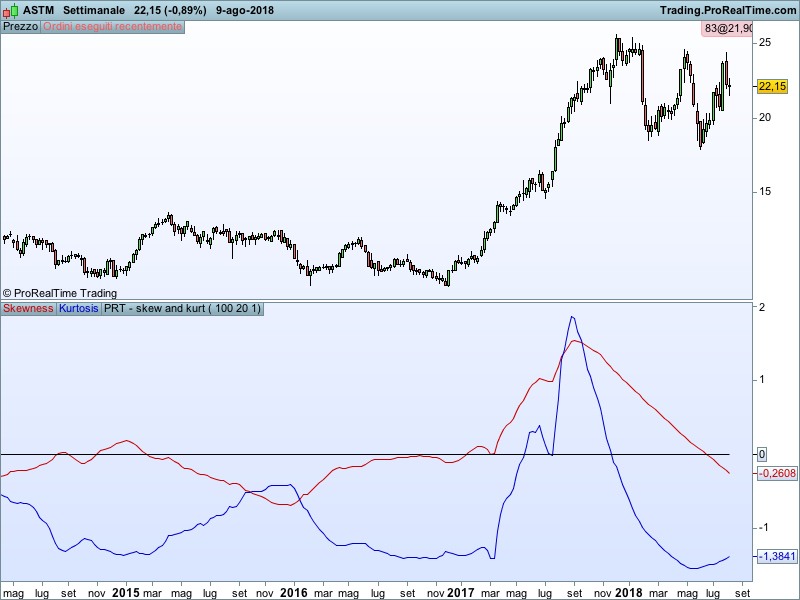

Once the average of the individual variables is calculated, that average is ranked against all stocks. Put another way, each stock’s composite valuation is compared to all other stocks. These ranks are then sorted into quintiles from the cheapest 20% to the most expensive 20% .

13 Best Emerging Market Stocks to Buy According to Hedge Funds - Yahoo Finance

13 Best Emerging Market Stocks to Buy According to Hedge Funds.

Posted: Mon, 10 Apr 2023 10:42:39 GMT [source]

ClearOne is an easy, affordable, and compliance-proof solution for all the challenges faced by SMEs. https://1investing.in/ by Archit Gupta, Srivatsan Chari, and Ankit Solanki, ClearTax is helping millennials pay their own taxes in a simple and hassle-free manner. Based in Gurgaon, Haryana, Sqrrl has a team of 40 people including the founders namely Dhananjay Singh, Sanjeev Sharma, and Samant Sikka. The company has also partnered with Google Pay for a simplified way to invest in Mutual Funds and National Pension System. 166 billion initial public offering that is set to be India’s largest ever. An arm of the company was also recognized as a bullion depository at the International Financial Services Centre at GIFT City in Gujarat.

Why this is the time to buy Gold, Silver and Bitcoin (According to Robert Kiyosaki – Rich Dad Poor Dad’s author)

Block can then offer the merchant’s payroll services to accommodate the new employees they hire. UiPath, another newer company, gained over 23% on its first day of trading in April. PATH’s a leading developer of RPA software and generates an average AVR of over $650 million from over 8,000 global customers.

The why training a neural network is hard information, news and research that you may receive from Top1 Insights for educational and informational purposes only and is not trading, investment, or advice. You should seek your own investment advice from an independent certified financial adviser if you have any doubts who will consider your personal objectives and circumstances. The financial sector is ripe for upheaval, and there is a strong possibility that some of the best-performing stocks over the next decade will be fintech stocks. This is an industry to monitor closely; nevertheless, as is typically the case with new industries, it is vital to exercise prudence and maintain minimal positions. From a fintech standpoint, the most exciting payment platform is Mercado Pago.

Another Fintech that’s worth watching is a financial technology company in the challenger banking sector – SoFi. This Fintech added 377,000 new members and 10 million new Galileo accounts the last quarter of 2021. The company is worth keeping tabs on as it has potential growth catalysts that investors are excited about.

The platform provides investors with a dashboard of all their mutual fund investments and also accepts service requests. The company is seen as one of the best plays on the country’s adoption of financial technology. The company's BNPL products witnessed volumes of $4.9 billion in Q2, more than tripling on a year-over-year basis. PYPL recently launched its new BNPL offering called PayPal Pay Monthly, which allows consumers to spread payments out over longer periods of time.

Shiksha Finance

The organization was founded in 2013 by Ashank Kumar and Harshil Mathur. In addition to managing the marketplace, applications for working capital loans and handling money transactions, businesses can send and receive invoices with clients and regular commissions. Fintech is the term financial institutions use to describe the technology powering their back-end systems in the early 21st century. Although consumer-oriented services have become more prevalent since then, the definition has also changed to reflect this trend.

- Cashfree has an Account API that integrates financial services into the app.

- Cube Wealth LogoCube Wealth was founded by Satyen Kothari in 2016, who had previously founded Citrus Pay.

- Indian banks have heavily invested in digital technologies to compete with new financial players.

- The platform aims to target the age group who comprise 15-20% of smartphone users.

Since its founding in 1935, Morgan Stanley has become one of the most iconic brands on Wall Street. MS doubled the size of its quarterly dividend in 2021, thanks to strong performances from its traditional services as well as from its recent acquisitions, like E-Trade. Headquartered in Charlotte, N.C., Bank of America is the second largest bank in the U.S.

Upcoming Fintech IPOs

For example, a couple of years ago, it acquired Nasdaq's fixed-income trading platform for $190 million to improve customers' access to Treasuries while reducing the cost of trading. Tradeweb Markets is a one-stop shop that helps the most prominent Wall Street players trade numerous products. Tradeweb Markets and Interactive Brokers are two longtime fintechs that have modernized trading. As with Lemonade above, PayPal enjoys a strong cash position relative to its competitors.

This payment processing arm was initially created as a way to allow unbanked consumers to purchase products through the company’s e-commerce platform. Finin LogoFinin is a fintech startup that has launched itself as a “neobank”, in partnership with SBM bank, a wholly-owned subsidiary of the State Bank of Mauritius in India. The “neobank” has an AI-driven experience for its users which gets insights from your spend-save behaviour. It can be linked to all your bank accounts and keeps a track of your transactions and budgets. Users also receive customized investment options and hyper-personal financial tips that take into consideration your pay cheque, lifestyle, marital status, and more.

Fiserv, a payments firm that helps financial institutions shift from physical and manual processes to digital banking solutions, is the next best fintech stock. Fiserv’s customers include card issuer processing and network services, payments, e-commerce, and merchant acquisition and processing organizations. Clover’s cloud-based point-of-sale technology is one of its primary offerings. Additionally, open banking and mobile phones facilitate fintech innovation. Open banking legislation lets users provide third-party service providers access to their bank accounts and investment information.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Before you buy, research the financial sector and get familiar with ins and outs of this key industry. Returns are not guaranteed, and the performance of individual stocks can be highly volatile—even among the biggest companies in the financial sector. The financial sector is heavily regulated, and it’s possible for the government to take further action, like requiring banks to increase their capital reserves even more.

With the emergence of online wallets and cryptocurrencies, the future of financial services is trending towards cashless transactions. It is essentially an economic industry composed of companies that use technology to make financial services more efficient. They are used mainly by individuals to help in mobile payments, insurance, cryptocurrency and blockchain technology, stock trading, digital lending and credit, budgeting and much more. Tech-focused startups and similar new market entrants are disrupting the way in which the financial services industry conducts its operations. The Indian fintech industry recognises Paytm as a well-known brand that is linked to digital payments in India. With a substantial customer base in India, Paytm’s brand identity has facilitated it in securing a significant share in the fintech industry.

Epay later LogoAkshat Saxena, Aurko Bhattacharya and Uday Somayajula are the founders of ePayLater. It offers a simple checkout experience by providing customers with the ability to conclude a transaction with just one click of a button. It is a ‘Buy Now, Pay Later’ solution through which customers can get access to an instant credit limit to make faster purchases.

The firm is also focusing on capturing growth via emerging payment solutions like buy now, pay later . The solid demand for digital payments has attracted new as well as established players in the fintech space. A report by research firm CB Insights revealed that fintech funding surged 168% to nearly $132 billion in 2021. It's worth noting that $1 out of every $5 of venture capital funding in 2021 was invested in a fintech startup. A COVID-related boost for fintech stocks may be fading, but the long-term prospects for the financial technology industry remain strong.

3 No-Brainer Stocks to Buy With $200 Right Now - The Motley Fool

3 No-Brainer Stocks to Buy With $200 Right Now.

Posted: Wed, 05 Apr 2023 09:21:00 GMT [source]

They initially offered a smart card-based payment and loyalty solution for the petroleum sector. Its 'Plutus PoS' solution is a cloud-based software that can be integrated with a generic POS terminal to allow retailers to accept debit and credit cards, e-wallets, QR codes, and UPI-based payments. Paytm LogoPaytm was founded in 2010 and is India’s largest payment company that offers consumers multi-source and multi-destination payment solutions. They allow consumers to make payments from any bank account to any other bank account free of cost, i.e., 0% fee charges. Over 8 million merchants have availed its comprehensive payment solutions.

- Kuants LogoKuants was founded in the last month of 2017, by Ayush Gangwar and Mohit Bansal.

- What’s even more impressive—Upstart is still a relatively new platform—is that it’s already achieved profitability.

- PayPal Holdings and Square-parent Block reported third-quarter earnings on Nov. 3.

- Over the last quarter-century, technological advancements and legislative modifications have enabled tech-focused startups to establish a foothold.

- Based on key financial metrics such as the price-to-sales ratio, shareholder yield and the price-earnings ratio, the following 3 stocks made the list for top value stocks in the Fintech industry.

Overall, Q2 revenue grew 21% year-over-year to $5.5 billion, while adjusted earnings per share increased 31% to $2.56. Gross dollar volume, which indicates activity on the Mastercard network, surged 14% on a local currency basis to $2.1 trillion. What's more, each offers significant upside potential to current levels based on their consensus price targets. Per the World Bank, about 67% of adults worldwide now make or receive a digital payment. Furthermore, the proportion of adults utilizing digital payments in developing economies increased to 57% in 2021 from 35% in 2014. One of its founders, Max Levchin, was also one of the co-founders of PayPal.