Posted by:

Category:

Comments:

Post Date:

How to Invest Currency: Wise The way to get Been

REITs buy industrial otherwise qualities and spend regular distributions on the traders on the rental income gotten because of these functions. REITs change to your stock transfers meaning that render their traders the new advantageous asset of immediate liquidity. The fresh production created by a secured asset trust the kind of advantage. As an example, of many brings shell out every quarter returns, while securities fundamentally spend interest every quarter. In several jurisdictions, different varieties of money try taxed in the additional costs. The new presumption out of a positive return in the way of money or speed adore which have mathematical relevance 's the center properties out of using.

Basic & Poor's rates you to definitely as the 1926, dividends provides provided almost a 3rd out of overall collateral go back to possess the new S&P five-hundred while you are financing progress has discussed a couple of-thirds. Investment progress are thus a significant little bit of using. Paying, generally, are getting money to function to have an occasion inside some sort of enterprise otherwise performing to make self-confident productivity (we.e., payouts you to definitely surpass the amount of the original funding). It is the work out of allocating info, constantly funding (i.elizabeth., money), with the expectation of generating an income, cash, or development. You to definitely glance at the historic speed of go back of your significant asset classes signifies that the stock exchange is about to give the greatest shag for the dollars. Typically, the newest stock market's mediocre annual return are 10percent prior to rising prices; other resource classes scarcely already been near to one to.

Some simulators actually allow it to be pages so you can compete keenly against other people, getting an extra extra to expend carefully. Incidentally, using a small amount continuously over time inside a mutual finance is also offer the benefits of money rates averaging (DCA) through the elimination of the newest https://www.youtube.com/watch?v=GQVHkA-Wv14 impression out of volatility. Based on how have a tendency to you change, this type of costs adds up, connect with the portfolio's go back, and deplete how much money you must purchase. Yarilet Perez is an experienced media blogger and truth-examiner which have a master from Research inside the Journalism. She's got did inside numerous towns layer cracking news, government, training, and a lot more. Their options is actually personal financing and you will paying, and home.

Such, with just step one,100, you could only be able to invest in two organizations. Some investors should get a working submit controlling the opportunities, and others want to set it up and forget it. Your decision can get transform, however, select a means to begin.

They’lso are an ideal way for beginners to begin investing since the they frequently wanted very little currency and they create the majority of the task to you personally. That’s not to imply you shouldn’t remain sight on your account — this is your currency; you do not wish to be completely hands-of — but an excellent robo-advisor will do the newest heavy-lifting. To other investing desires, such as to shop for a house, take a trip otherwise education, consider carefully your day views and also the matter you desire, following works in reverse to break one to matter into month-to-month or a week opportunities. You will have pros and cons on the stock exchange, naturally, however, spending young function you've got ages to drive her or him out — and you may years for your money to grow. If you’lso are troubled in the in case your share is enough, focus rather about what matter feels down given your financial situation and you can wants. A huge number of these types of enjoyable strong technology startups is actually located in European countries, in addition to their creators try ultimately looking for funding more readily on family grass.

However, with paying, you're taking on the much more risk in the anticipation away from higher efficiency. Each other form of financing have a tendency to very own 1000s of holds or any other assets. This makes her or him a varied solution than just just one inventory. From the owning a selection of opportunities, in different businesses as well as other asset groups, you might buffer the fresh loss in one single urban area for the growth an additional.

What's more, the prosperity of index spending shows that if your aim is long-term riches building, a robo-mentor get suit your style. Because the Improvement introduced, other robo-basic enterprises was based. Centered on line agents such as Charles Schwab have extra robo-for example consultative functions. Centered on a study by the Charles Schwab, 58percent from Us citizens state they'll fool around with a global robo-suggestions from the 2025. Common finance try professionally handled pools from investor finance one attention the assets in numerous areas.

- Perhaps the common is stocks, ties, a house, and you will ETFs/common money.

- Their benefits is tax-deductible and your account balance increases tax deferred.

- Other types of investment to look at are a property, Dvds, annuities, cryptocurrencies, merchandise, antiques, and you will gold and silver coins.

- Yet not, efficiency within these account you'll nevertheless be less than the newest enough time-label come back you would secure spending — inside a host which have large rates of interest for example our company is currently feeling.

- Merchandise were metals, oils, grains, and creature issues, along with financial instruments and currencies.

- Derivatives is actually economic tool you to definitely derive the well worth out of other tool, including an inventory or list.

Although not, in recent years, solution investment have been delivered within the financing platforms which can be accessible to merchandising investors. Actually, investors shell out almost nine moments more within the charges for actively handled mutual money. Prefer a list financing, and of one's money resides in their portfolio to enhance over the years. The price of you to government, in addition to expenditures to possess investments, government, sales product, an such like., happens of your funding efficiency.

Exactly what are the Risks of Paying?

Using makes it possible to create your money be right for you on account of compounding. Substance money means any output you have made is reinvested so you can earn a lot more efficiency. And the prior to you start paying, the greater amount of possible benefit you acquire of compounding. Meaning, once you decide to sign up for a 401(k), the bucks goes straight from your own income on the account rather than actually therefore it is to the financial. Certain 401(k)s now tend to place your financing by default within the a target-day finance — more about those underneath — but you may have other options.

The newest Amsterdam Stock-exchange try created in 1602, as well as the New york Stock market (NYSE) inside the 1792. Therefore and this ones should you use to help make your retirement portfolio? The answer will be crisper when you know how to favor investments. One feeling is particularly solid whenever rising cost of living is actually large, but it's along with genuine while in the normal years when rising prices try running 2percent otherwise step threepercent.

Once you happen to be happy to undertake some chance to enhance your currency along the long-term, investing the market the most preferred cities to take action. Risk inside paying refers to the odds of losing specific (otherwise, rarely, all) of the currency you've invested. Opportunities confronted with lowest chance tend to build lowest otherwise moderate returns; investments one carry high risk supply the potential for large benefits. If you'd like an algorithm and make funding choices to you personally, in addition to for income tax-losings harvesting and you may rebalancing, a good robo-advisor can be for your requirements.

They can also provide many financing products and informative tips. They have typically focused so you can highest-net-really worth someone and frequently wanted tall investment. Discount brokers have much lower thresholds to possess availability, however, usually provide a far more sleek set of characteristics.

Directory finance and you can ETFs are generally lower-cost and simple to manage, as it can take merely four to five fund to build sufficient diversification. If the offers goal is over 2 decades aside (such as old age), the majority of your bank account is going to be inside brings. However, choosing particular stocks might be tricky and time intensive, so for many of us, how to spend money on brings has been low-costs stock common money, directory fund or ETFs.

Basically, an excellent robo-advisor is a support provided by a brokerage. It can build and maintain a collection away from stock- and bond-dependent list finance built to maximize your go back prospective while maintaining the risk height appropriate for your needs. Paying concerns getting your bank account to work by buying assets — including carries otherwise bonds — generate payouts (often called output) away from first funding. When talking about paying, anyone have a tendency to consider monetary areas where investors connect to buy and sell assets, including holds or ties.

Know your investment choices

The kind of money you choose you are going to almost certainly rely on you everything you seek to obtain and how sensitive and painful you are in order to exposure. And if nothing exposure basically efficiency down productivity and you can vice versa to own just in case risky. Investment can be made in the carries, bonds, home, gold and silver coins, and. Spending can be produced that have currency, possessions, cryptocurrency, and other sources of replace. Surprisingly, you could potentially invest in a home that have step 1,one hundred thousand. You do not be able to buy a living-producing possessions, you could spend money on a buddies one does.

Online Brokers

When a financial investment gains within the well worth ranging from when you order it therefore sell it, it’s labeled as appreciate. If you make wise decisions and you will purchase the best urban centers, you can reduce the risk factor, increase the prize grounds, and you will create meaningful output. By paying, you could greatest combat rising prices, increasing your odds of having the ability to afford the exact same count of products and services subsequently that you can today.

Consider, there is no need tons of money to start, and you will tailor since your means change. That it personalized-tailored guidance warrants the higher fees which they normally charge, compared to the most other agents. These may were a percentage of the deals, a share of one's possessions less than government, and often, a yearly membership percentage. Shared fund and you will ETFs invest in holds, bonds and you will merchandise, following a particular means.

Imagine that you choose to buy one display away from inventory within the each of four businesses with your step one,000. And if a deal percentage out of ten, you'll happen 50 inside exchange will cost you which is equal to four percent of your own 1,100000. Simply how much you will want to purchase utilizes the money you owe, financing objective and if you should arrive at they.

The newest difficult region try finding out what you should buy — and how much. Young people is much more confronted by fixed-income compared to the its more mature counterparts. "Bogleheads are investing for the long carry — the idea is that you happen to be putting money into your account and you can simply leading to it, perhaps not coming in contact with they or deciding on it for another 30 ages," she said.

If you intend to trade seem to, below are a few all of our listing of brokers to own rates-mindful investors. Be sure you understand if a fund sells a money weight before you buy it. Here are some your own broker's list of zero-load financing and no-transaction-commission financing to avoid such costs. The newest MER is the percentage paid from the shareholders out of a mutual money (otherwise ETF) and you can would go to the costs of running a fund.

In the event the efficiency increase, money including TLT will suffer — while the thread output move inversely to prices. That's been the case this season, that have TLT off regarding the 50percent from its checklist higher. Simultaneously, if the efficiency slide, bond financing would be to surpass. Dan Griffin, a home-stated Boglehead based in Fl, said he spotted the brand new meme inventory rally inside the entertainment.

Investing

Whenever investing, a great principle isn’t to get each of your own egg in a single basket. By the spread your hard earned money around the some assets, you can lose financing risk. Due to this the new assets i outline below have fun with mutual fund or replace-exchanged fund typically, that allows people to purchase baskets out of securities rather than individual brings and you can bonds. One important action for taking before using should be to introduce a keen disaster fund. This really is cash reserved inside an application which makes it readily available for small withdrawal, including a family savings.

And, you could invest smaller to get started with a financing than simply you’d probably spend to buy personal carries. Should you decide offer this type of stocks, the new round trip (the new act of purchasing after which promoting) perform charge you a total of 100, or ten percent of the very first deposit quantity of step one,100. Such will set you back by yourself is also consume in the balance ahead of your assets need an opportunity to secure an optimistic come back. Variation is a vital money build understand. In a nutshell, by committing to a selection of property, or diversifying, your slow down the risk that one money’s performance is also severely hurt the new go back of your full investment collection. You could think of it while the financial slang to possess maybe not placing your entire eggs in a single basket.

Almost any station you choose, how you can reach finally your a lot of time-name financial requirements and lower exposure should be to spread your finances across the various resource classes. That’s entitled resource diversification, plus the ratio of dollars you devote for the for each and every investment group is known as resource allotment. Next within this for every advantage class, you’ll also want to diversify on the several investments.

Therefore, a key consideration to have traders is how to manage the chance in order to achieve the monetary wants, whether these requirements try quick- or enough time-term. Alternative investments try a capture-all category that includes hedge finance and personal collateral. Hedge money are incredibly-titled as they possibly can hedge their money bets because of the supposed a lot of time and you will small on the holds or other investment. Personal collateral allows enterprises to improve financing rather than supposed personal. Hedge financing and private guarantee were normally only available in order to wealthy people considered "licensed traders" who came across particular earnings and you can net really worth conditions.

Be aware that, the greater the brand new MER, the greater it influences the fresh fund's total come back. More often than not, the agent often costs a payment whenever you exchange stocks, if or not you get otherwise promote. Particular agents charges no change earnings whatsoever, nevertheless they make up for they with other costs. After you subscribe an agenda, contributions are built automatically at a level your place.

Such, when the a flood has an effect on the production from grain, the cost of grain you are going to boost because of shortage. Once you buy ties, you’lso are loaning currency for the issuer for a fixed period of go out. In exchange for the loan, the fresh issuer pays you a fixed speed away from return as the really since the currency you initially loaned her or him.

Just step 3percent rising prices, when you attend invest a one hundred costs your stashed inside a java lasts year, that cash will only enable you to get 97 property value goods compared with just what it could have obtained you a year ago. In other words, the bucks your’ve been looking at doesn’t buy to they used to, because the everything has obtained 3percent more costly. That’s how it’s you'll be able to to save cash and you will lose cash — that is, paying power — at the same time.

Which have their collection steadily and you can properly broadening through the years. As they aren’t earnestly handled, ETFs usually cost less to purchase than shared money. And you can typically, not many earnestly treated common financing provides outperformed their benchmark indexes and you can passive money long-term. Securities ensure it is investors in order to “become the financial.” When companies and you will countries need boost money, they borrow money of traders because of the giving financial obligation, named bonds. Businesses offer stock to raise money to cover their organization surgery.

However anybody else can offer a specific amount of commission-100 percent free positions for starting a merchant account. “Over the past 30 years, an investment on the S&P 500 will have hit a tenpercent annualized get back,” claims Sandi Bragar, managing manager during the money government business Aspiriant. “Missing the new twenty five finest solitary days during that several months might have resulted in only a great 5percent annualized get back.” You to definitely a note never to offer the investment inside a panic if business goes down. It’s very hard to predict whenever stock values increase again, and many of the biggest days of stock exchange gains features adopted days of high losings.

Free Products

Offers profile portray an amount all the way down chance however, give a reduced reward. One which just place your money to the stock exchange or any other investments, you want a fundamental comprehension of simple tips to purchase your finances the proper way. Based inside the 1993, The newest Motley Deceive is actually an economic services company dedicated to and then make the country smarter, happy, and you can wealthier. The newest Motley Deceive are at millions of people each month because of all of our advanced using possibilities, 100 percent free advice and business investigation to the Fool.com, top-ranked podcasts, and non-money The fresh Motley Deceive Base.

The brand new spending guidance considering on this page is actually for educational intentions only. NerdWallet, Inc. will not offer consultative otherwise broker features, nor will it recommend otherwise indicates buyers to buy or offer sort of brings, securities or any other investments. NerdWallet, Inc. is actually an independent author and assessment solution, maybe not a financial investment mentor. The posts, interactive systems and other posts are provided to you personally free of charge, while the mind-let systems and for informative objectives merely. NerdWallet doesn't and should not ensure the precision or usefulness out of people information regarding your individual items.

2023 seems getting various other active seasons on the market. In the beginning, of numerous pundits was yes within forecasts out of a recession, nonetheless it never materialized. In reality, gross residential unit increased 5percent last one-fourth, alarming of a lot. Brokerage firm Robinhood, after synonymous with day trading, is seeing a similar rotate to raised productivity and you will prolonged-term convinced.

When you are still unconvinced from the strength out of investing, have fun with all of our rising prices calculator observe exactly how rising prices can cut on the your own discounts if you don't purchase. Spending.com -- U.S. brings increased to your Monday after research showed that rising prices cooled far more than just requested within the October, offering... Thread ETFs are one way merchandising buyers have used to fully capture rising rates.

As the account is financed, you'll need to select your assets. Stock market simulators give profiles fictional, virtual money to find a portfolio out of stocks, options, ETFs, or other ties. These simulators normally tune speed motions from investment and you will, with regards to the simulator, most other renowned considerations for example change charge otherwise dividend winnings.

Options agreements is a well-known by-product providing you with the buyer the fresh right although not the responsibility to purchase or promote a safety from the a fixed speed within this a specific time period. Derivatives usually utilize power, making them a top-risk, high-prize suggestion. Risk and you will come back standard may vary widely in the exact same advantage class. Such, a blue processor one investments to the Nyc Stock-exchange get a highly additional risk-go back character of a mini-cap you to definitely deals on the a tiny exchange. One good way to pick how much exposure when planning on taking would be to concentrate on the kind of economic mission you're functioning on the.

Share this post

Related

Posts

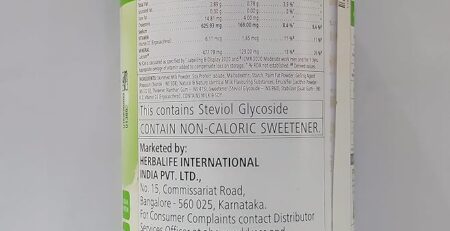

Herbalife Formula 1 Shake for Weight Loss

About this item Includes the antioxidant vitamins C and E Create your own shake recipes by adding fresh fruit Diets...HERBALIFE Weight Loss Combo Formula 1 Mango Flavor

About this item A healthy meal replacement that fulfills nutritional needs of the body.Home