Posted by:

Category:

Comments:

Post Date:

Average Payment Period Formula + Calculator

Content

It shows how long it takes the company, on average, to pay for products, services and supplies. For this, the APP considers the interval between the purchase date and the effective payment to third parties. With this result in hand, the manager is able to assess the impact of accounts payable on cash flow, reconcile payments and receipts, make projections and better manage working capital. For this reason, the APP is one of the most important KPIs to understanding the behavior of finances in the organization. For a more complete analysis, it is also necessary to consider the average time for payment receipt of application services. Most of the parts that are used in the headphones are purchased on credit. The reason that the company wants you to calculate the average payment period is that they want to be as lean as possible in its operations.

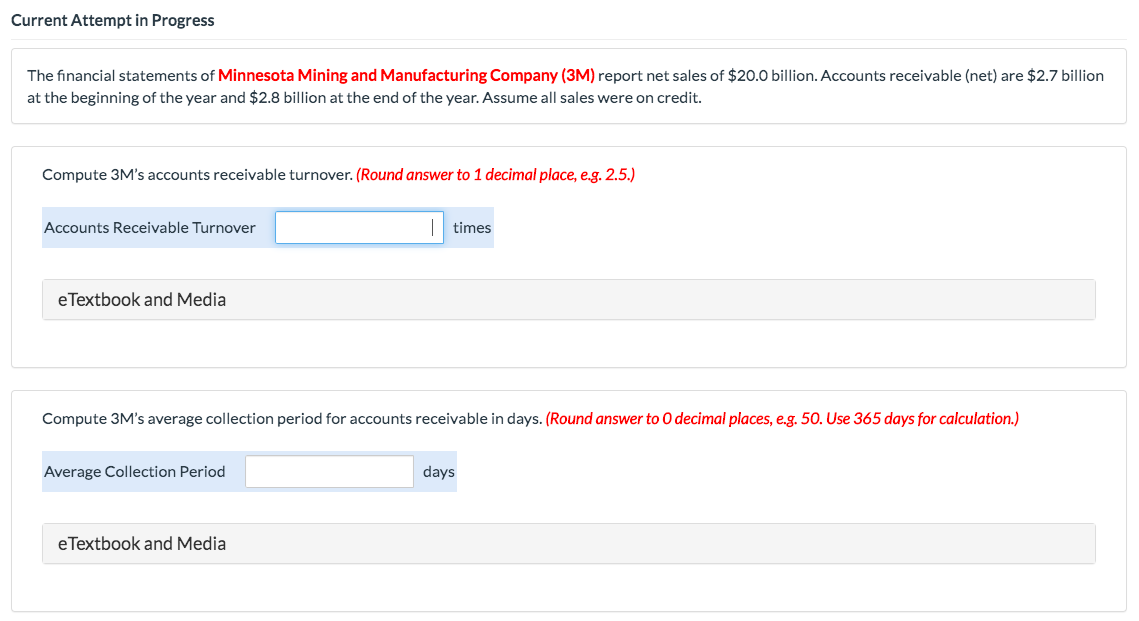

While a shorter average collection period is often better, too strict of credit terms may scare customers away. The average collection period is closely related to the accounts turnover ratio, which is calculated by dividing total net sales by the average AR balance. Companies may also compare the average https://online-accounting.net/ collection period with the credit terms extended to customers. For example, an average collection period of 25 days isn’t as concerning if invoices are issued with a net 30 due date. However, an ongoing evaluation of the outstanding collection period directly affects the organization’s cash flows.

Average Payment Period (APP)

The indicators most influenced by the APP are liquidity, profitability and indebtedness. Liquidity indicates the company’s ability to settle its obligations, while profitability shows its ability to generate profit and indebtedness reveals the degree of commitment of assets in relation to liabilities.

What is a good average collection period?

The formula for calculating average collection period is: Average collection period = (accounts receivable / sales) x number of days in a year. A shorter average collection period (60 days or less) is generally preferable and means a business has higher liquidity.

Also since it helps the business know when to pay vendors it can help the company in making cash flow decisions. Also known as an important solvency ratio, the average payment period assesses how much time it takes for a business to pay its vendors, in the case of purchases made on credit.

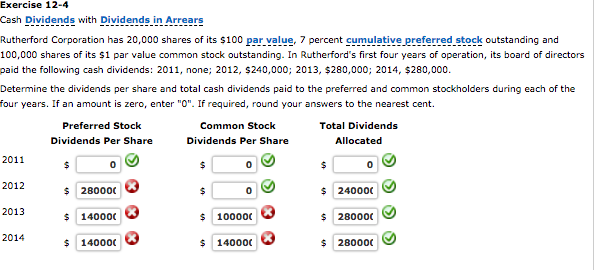

What is the average accounts payable of the company?

It proves to be a prerequisite for analyzing the business’s strength, profitability, & scope for betterment. While the supplier or vendor delivered the purchased good or service, the company placed the order using credit as the form of payment . If the supplier is offering any discount for prompt payments, then you need to compare the amount of discount offered and the benefit of credit length offered to choose the best fit. Further, to obtain a better understanding, one should compare the APP ratio to industry averages, to the ratio of leading firms in the industry and to the firm’s own historical results. GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services.

- But it is crystal clear that the average payment period is a critical factor, specifically when it comes to assessing the firm’s cash flow management.

- A low average collection period indicates that the organization collects payments faster.

- Most of the parts that are used in the headphones are purchased on credit.

- The average payment period analysis is only relevant when compared to credit terms granted to the business.

- It means that Company ABC’s average collection period for the year is about 46 days.

When analyzing average collection period, be mindful of the seasonality of the accounts receivable balances. For example, analyzing a peak month to a slow month by result in a very inconsistent average accounts receivable balance that may skew the calculated amount. For the formulas above, average accounts receivable is calculated by taking the average of the beginning and ending balances of a given period. More sophisticated accounting reporting tools may be able to automate a company's average accounts receivable over a given period by factoring in daily ending balances. Alternatively and more commonly, the average collection period is denoted as the number of days of a period divided by the receivables turnover ratio.

What does an average collection period of 30 days indicate for a company?

Professional services may have fewer upfront expenses to maintain, while industries like construction work on longer term projects with longer payment terms to match. That way, your clients will see all the information they need clearly laid out in the invoice average payment period terms, encouraging them to pay you automatically and on time. Compliance with fecal coliform bacteria or E coli bacteria limitations shall be determined using the geometric mean. Rafael Corrêa da Costa, Cuiabá Brazil, Bachelor of Aeronautical Science.